If you live or work in New York State, understanding the intricacies of NYS income tax is essential for staying compliant and maximizing your financial health. Whether you're a resident, non-resident, or part-year resident, the state's tax system can feel overwhelming at first glance. But don't worry—this guide is here to help you navigate the rules, rates, deductions, and credits associated with NYS income tax. From learning how the tax brackets work to uncovering potential deductions, we'll break everything down into bite-sized chunks. By the end of this article, you'll feel confident about handling your tax obligations and making informed financial decisions.

New York State imposes income taxes on individuals based on their earnings, with rates varying depending on filing status and income level. Unlike federal taxes, which are uniform across the U.S., NYS income tax has its own set of rules and nuances that taxpayers must understand. Whether you're filing as a single individual, head of household, or married couple, it's crucial to know how these factors impact your tax liability. Additionally, New York offers several tax credits and deductions that can significantly reduce your taxable income if you qualify.

In this comprehensive guide, we’ll explore everything you need to know about NYS income tax, including how it works, what you can deduct, and how to avoid common mistakes. We’ll also address frequently asked questions and provide practical tips for managing your taxes efficiently. Whether you’re a first-time filer or a seasoned taxpayer looking to optimize your returns, this article will serve as your go-to resource for all things related to NYS income tax.

Read also:Vegamovies Original A Comprehensive Guide To The Streaming Sensation

Table of Contents

- What Are the Rates and Brackets for NYS Income Tax?

- How Does NYS Income Tax Differ from Federal Income Tax?

- What Deductions and Credits Are Available for NYS Taxpayers?

- Who Needs to File a NYS Income Tax Return?

- How Can You Avoid Common Mistakes When Filing NYS Taxes?

- What Are the Penalties for Late or Incorrect NYS Tax Filing?

- How Do Non-Residents Pay NYS Income Tax?

- Frequently Asked Questions About NYS Income Tax

What Are the Rates and Brackets for NYS Income Tax?

New York State employs a progressive tax system, meaning that higher income levels are taxed at higher rates. The state has several tax brackets, each corresponding to a specific range of taxable income. For the 2023 tax year, the rates range from 4% to 8.82%, depending on your filing status and income level. Single filers, married couples filing jointly, and heads of households all have different thresholds for each tax bracket.

Here’s a breakdown of the tax brackets for single filers in New York State:

- Up to $8,500: 4% tax rate

- $8,501 to $11,700: 4.5% tax rate

- $11,701 to $13,900: 5.25% tax rate

- $13,901 to $21,400: 5.9% tax rate

- $21,401 to $80,650: 6.33% tax rate

- $80,651 to $215,400: 6.85% tax rate

- $215,401 to $1,077,550: 8.82% tax rate

Married couples filing jointly and heads of households will find slightly different thresholds, but the basic structure remains the same. It’s important to note that these rates apply only to taxable income after deductions and exemptions. Understanding your tax bracket can help you plan your finances better and ensure you’re not overpaying.

How Are Tax Brackets Adjusted for Inflation?

One key aspect of NYS income tax is how tax brackets are adjusted annually to account for inflation. This adjustment prevents taxpayers from being pushed into higher tax brackets due to cost-of-living increases. The New York State Department of Taxation and Finance reviews these figures every year and makes necessary adjustments. For example, if inflation rises by 3%, the income thresholds for each bracket may increase accordingly.

These adjustments are critical for maintaining fairness in the tax system. Without them, individuals could experience "bracket creep," where rising nominal incomes push them into higher tax brackets despite no real increase in purchasing power. By keeping pace with inflation, NYS ensures that its tax system remains equitable and aligned with economic realities.

How Does NYS Income Tax Differ from Federal Income Tax?

While both NYS income tax and federal income tax aim to generate revenue for government operations, they operate under distinct rules and structures. One of the most noticeable differences lies in the tax rates. Federal income tax rates are generally higher than those of NYS, with brackets ranging from 10% to 37%. However, federal taxes also offer more extensive deductions and credits compared to state-level taxes.

Read also:Exploring Eve Hewson Movies And Tv Shows A Comprehensive Guide

Another difference is how income is treated. For federal purposes, certain types of income—like Social Security benefits or municipal bond interest—may be exempt from taxation. In contrast, NYS taxes most forms of income unless explicitly excluded. Additionally, federal tax brackets are standardized across the country, whereas NYS has its own unique system tailored to the state’s economic conditions.

Which States Have No Income Tax?

Not all states impose an income tax. In fact, seven states—Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming—do not levy any personal income tax. Two others, New Hampshire and Tennessee, tax only interest and dividend income. Comparing these states to New York highlights the importance of understanding regional tax policies when planning your finances or considering relocation.

What Deductions and Credits Are Available for NYS Taxpayers?

New York State offers a variety of deductions and credits designed to reduce taxable income and lower overall tax liability. Some common deductions include student loan interest, contributions to retirement accounts, and mortgage interest. Taxpayers may also claim itemized deductions such as medical expenses, charitable donations, and property taxes.

In addition to deductions, NYS provides several valuable tax credits. These include the Earned Income Tax Credit (EITC), which benefits low- to moderate-income workers, and the Child and Dependent Care Credit, which assists families with childcare expenses. Another notable credit is the Empire State College Tuition Credit, which helps offset education costs for eligible students.

Can You Claim Both State and Federal Deductions?

Yes, many deductions available at the federal level can also be claimed on your NYS tax return. However, there are exceptions. For instance, while the federal government allows a standard deduction, New York requires taxpayers to itemize their deductions instead. Understanding these differences is crucial for maximizing your tax savings and avoiding errors during filing.

Who Needs to File a NYS Income Tax Return?

Filing requirements for NYS income tax depend on various factors, including residency status, income level, and age. Generally, residents must file a return if their gross income exceeds a certain threshold. For example, single filers under age 65 must file if their income exceeds $8,500, while married couples filing jointly must file if their combined income surpasses $17,150.

Non-residents and part-year residents also have filing obligations if they earn income sourced from New York State. This includes wages earned while working in the state, rental income from property located in New York, or profits from a business operating within the state. Even if you live elsewhere but work remotely for a New York-based employer, you may still need to file a NYS tax return.

How Can You Avoid Common Mistakes When Filing NYS Taxes?

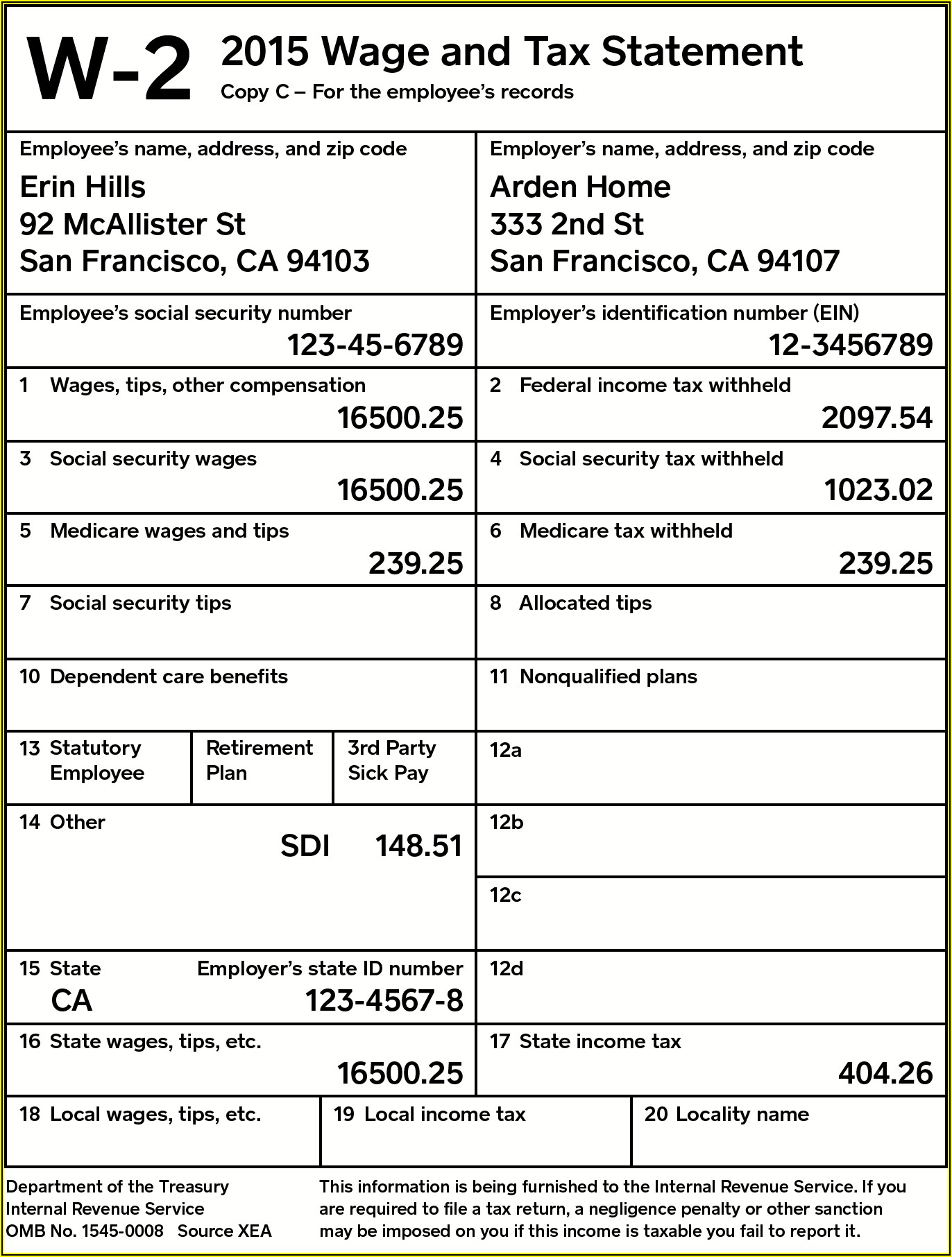

Filing taxes can be a daunting task, especially when navigating both federal and state requirements. To avoid costly errors, start by gathering all necessary documentation, such as W-2 forms, 1099s, and receipts for deductible expenses. Double-check your math and ensure that all information matches your records.

Another common mistake is failing to claim eligible deductions and credits. Many taxpayers overlook opportunities to reduce their tax liability simply because they’re unaware of what’s available. Consider consulting a tax professional or using reputable tax software to ensure accuracy and maximize your refund.

What Are the Penalties for Late or Incorrect NYS Tax Filing?

Failing to file your NYS tax return on time or submitting an incorrect return can result in significant penalties. Late filers face a penalty of 5% of the unpaid tax for each month the return is overdue, up to a maximum of 25%. Additionally, interest accrues on unpaid balances until the debt is settled.

Incorrect filings can also lead to audits or additional assessments. To avoid these consequences, file your return accurately and on time. If you’re unable to meet the deadline, request an extension before the due date to avoid late-filing penalties.

How Do Non-Residents Pay NYS Income Tax?

Non-residents who earn income in New York State are subject to NYS income tax on the portion of their earnings attributable to work performed within the state. This includes wages, bonuses, and other forms of compensation. Non-residents must file Form IT-203, the Nonresident and Part-Year Resident Income Tax Return, to report their New York-sourced income.

The calculation involves determining the percentage of income earned in New York relative to total income. For example, if a non-resident earns $100,000 annually and $40,000 of that comes from working in New York, they would pay NYS income tax on 40% of their total income. Understanding this allocation process is essential for accurate reporting and compliance.

Frequently Asked Questions About NYS Income Tax

What Happens If I Owe NYS Income Tax But Can’t Pay?

If you owe NYS income tax but cannot pay the full amount, contact the New York State Department of Taxation and Finance to explore payment options. They may allow you to set up an installment agreement or offer other relief programs. Ignoring the debt will only lead to additional penalties and interest.

Can I E-File My NYS Tax Return?

Yes, New York State encourages taxpayers to e-file their returns for faster processing and reduced errors. Most tax preparation software supports e-filing for both federal and state returns. Alternatively, you can use the state’s free online filing service if you meet the eligibility criteria.

Is There a Penalty for Filing Late Without Owed Taxes?

No, there is no penalty for filing late if you do not owe any taxes. However, it’s still advisable to file on time to avoid potential issues and ensure you receive any refunds owed promptly.

In conclusion, understanding NYS income tax is vital for anyone living, working, or earning income in New York State. By familiarizing yourself with the rates, deductions, credits, and filing requirements, you can minimize your tax burden and stay compliant with state laws. Remember to consult a tax professional for personalized advice and always double-check your filings for accuracy. With this knowledge in hand, you’ll be well-equipped to tackle tax season with confidence!

For more information on NYS income tax, visit the New York State Department of Taxation and Finance.